|

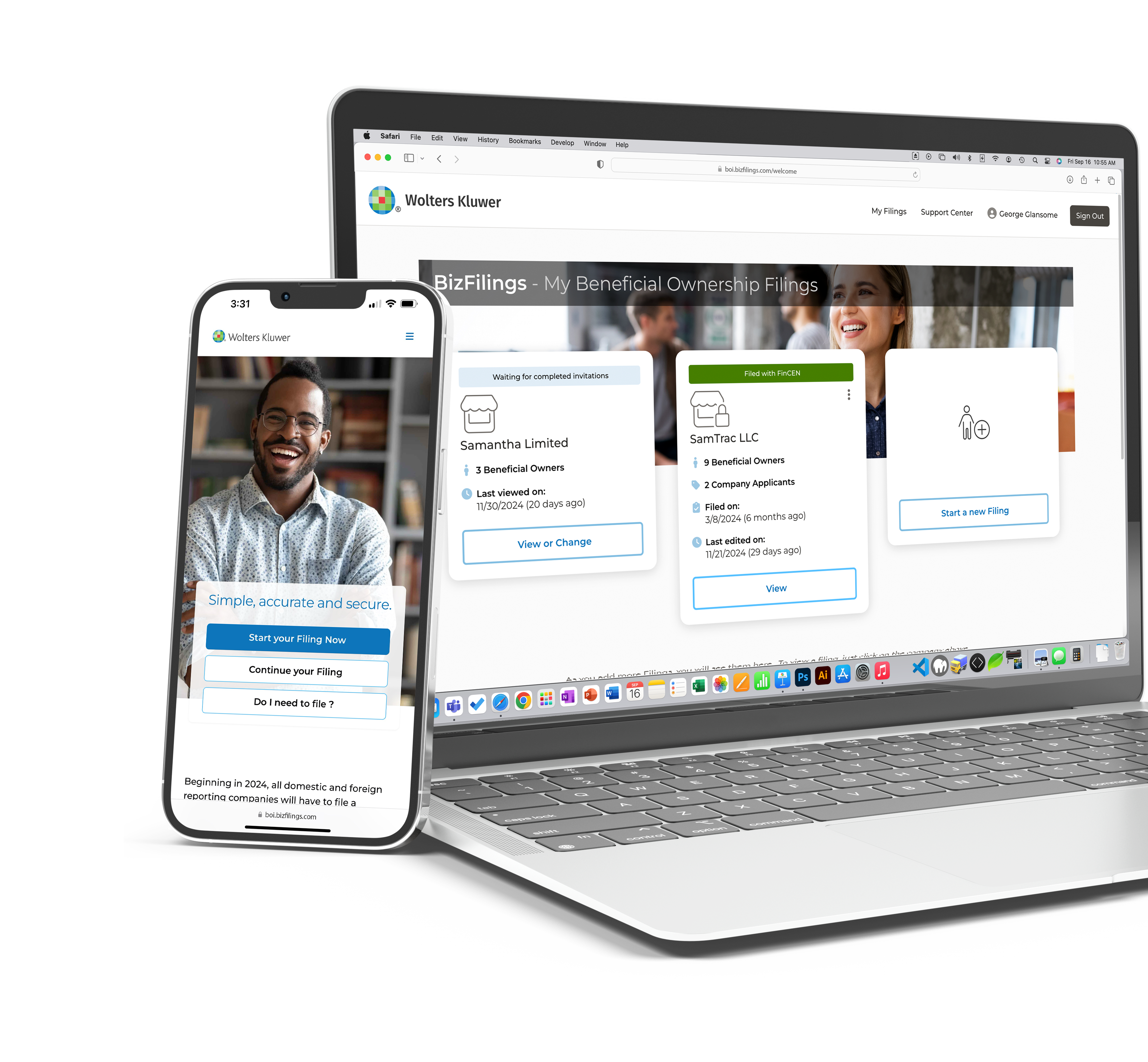

The Corporate Transparency Act went into effect on January 1, 2024. Many small businesses may need to file Beneficial Ownership Information (BOI) reports with FinCEN. |

|

What is the Beneficial Ownership Information report & the Corporate Transparency Act?

BOI reporting is part of the Corporate Transparency Act that Congress passed in 2021 to crack down on money laundering, financing of terrorism, tax fraud and other illegal acts. The BOI report will contain personal identifying information about a company's beneficial owners that will be filed with FinCEN - the U.S. Department of Treasury's Financial Crimes Enforcement network.

Am I REQUIRED to file a report?

Many businesses are required to file this report under the Act. Click the link below to go to the FinCEN website for more information and to see if your business is covered by the Corporate Transparency Act requirements. As of December 27, 2024, the Corporate Transparency Act is being challenged in court. Due to this, the reporting requirements currently have no deadline and failing to report is not subject to disciplinary action. However, voluntary reporting is allowed and encouraged. Please visit the FinCEN website for the most recent updates on this topic.

How do I file my BOI report?

Filing your BOI report directly with FinCEN is free of charge. You can find out more information on their website.